4 Passive Income Ideas for 2020 (Don’t Ignore #4)

In today’s low interest rate environment, it’s hard to find reliable income that can support the life you want to live. It’s gotten tricky and it’s more important than ever to find income producing ideas that grow your wealth – day in and day out.

The Problem…

Across the globe, central banks have attempted to boost their economies with ultra-low – or in some cases negative – rates. This has sent a ripple effect across all income producing assets. U.S. 10 year bonds yield are under 2%, while Japan and Germany yields are negative. You read that correct! Lenders pay these countries to take on their debt. It’s upside down.

As a result, you’ve probably noticed that most savings accounts and certified deposits (CDs) pay next to nothing. They hardly keep up with inflation. This has made the search for meaningful yield – ones that can pay the bills – a tough expedition.

So What Can You Do?

You’ve got to go out and pull income from sources that outpace inflation. There are a few ways to go about this. Rental properties, dividend stocks, peer-to-peer lending and options trading are practical ways to add side income.

Let’s dig into each and see how they stack up to one another.

- Rental Income

Younger generations are changing homeownership rates. As many come out of college with large debt loads, they postpone buying a home for a decade or more in some cases. This has brought about a massive shift in the real estate market.

Rental properties have become a cash cow for real estate investors. This is one area where we will see increased demand for rentals which should increase rent prices.

But this has also attracted the smart money. It’s harder today to buy a property and make a good chunk of change versus a decade or more ago. Plus, you also have to maintain and manage the property yourself or hire someone to do it. So this isn’t passive income by any means. It’s important to consider this before you get into a long-term investment like real estate.

Overall Grade: B-

- Peer-to-Peer Lending

Peer-to-peer lending (P2P) – also known as social or crowd lending – has taken off in recent years. It traces its roots back to 2005 when Zopa launched in the UK. Now companies like Prosper, Lending Club, Upstart and Peerform allow individual investors to offer loans to other businesses or individuals.

With P2P, you are essentially becoming a bank, loaning money – alongside others – to Larry down the street who wants to buy a car. You can see credit ratings and divvy up your loans amongst different risk buckets for higher yields. The average platform delivers a 4-7% annual yield to investors. And loans can start as little as $25.

This is a much lower barrier to entry than rental properties. And it’s definitely more hands off. But it requires tracking your money across multiple loans and there is risk of them defaulting (aka you lose your initial investment). Compare that to investment grade bonds that can hand you yields in 4% range, and it’s not all sunshine and roses. But if you are looking for higher yields and are comfortable with higher default risk, P2P lending offers solid hands-off income.

Overall Grade: B

- Dividend Stocks

There no denying it – dividend paying stocks provide real passive income. All you have to do is buy shares, sit back and watch the checks roll in.

And you can pocket truly reliable income. Companies like AT&T and Johnson & Johnson have been handing investor dividends every quarter for decades. Over a year, you can pocket yields in the 2% to 5% range on quality stocks. There is also the upside in capital gains as share prices could move higher. And you can reinvest your dividends to compound your returns over time.

So dividend income can be good, but it won’t massively increase your bank account overnight. This is a slow drip approach to wealth building.

Overall Grade: B+

- Professional Options Trading

While the income producing ideas above can hand you consistent income, they don’t compare to the profit potential you can capture with option trading. This is the ultimate wealth building tool.

Option trading allows you to pocket outsized income every day the markets are open. There is no slow drip of profits and income here. And when done right, you can properly control your risk.

There are several professional option trainers out there, but we believe that Bryan Bottarelli is the best of them. Bryan is a former fast-food worker turned millionaire. And he has built a community of traders with his proprietary War Room – a live trading chatroom. Every day, members join him to learn how to trade like an options pro.

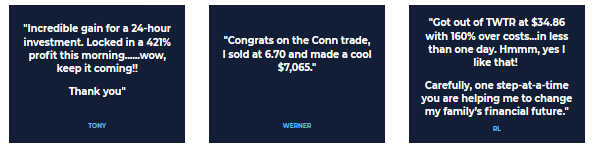

The results have been amazing. Just read what members are saying:

And Bryan just put together a special FREE Pro Trader Event where he teaches viewers about:

- His secret Pro Trader Tool – Learn how you can use it to make more gains in one day of trading than most folks make all year long. (99.9% of the investing public doesn’t know this chart exists).

- The key to spotting “W” and “M” Patterns – Identify the setups that will give you the chance to double your money every 18 days.

- How you can use the “Rule of 5 Profit System” for the chance to take $5,000 to a million-dollar portfolio in under a year.

To access his free training session, enter your email below.

Overall Grade: A

In Conclusion:

Traditional income producing investment like real estate and dividends stocks remain a great way to pocket side income and slowly build your wealth. But, they don’t compare to the daily profit potential that option traders experience. Our recommendation is to check out Bryan’s latest video and get a free lesson on how his three favorite chart patterns could make you $4,243 daily. You’d be an idiot to ignore this free event.

Sign up below and we will send it to your inbox immediately.